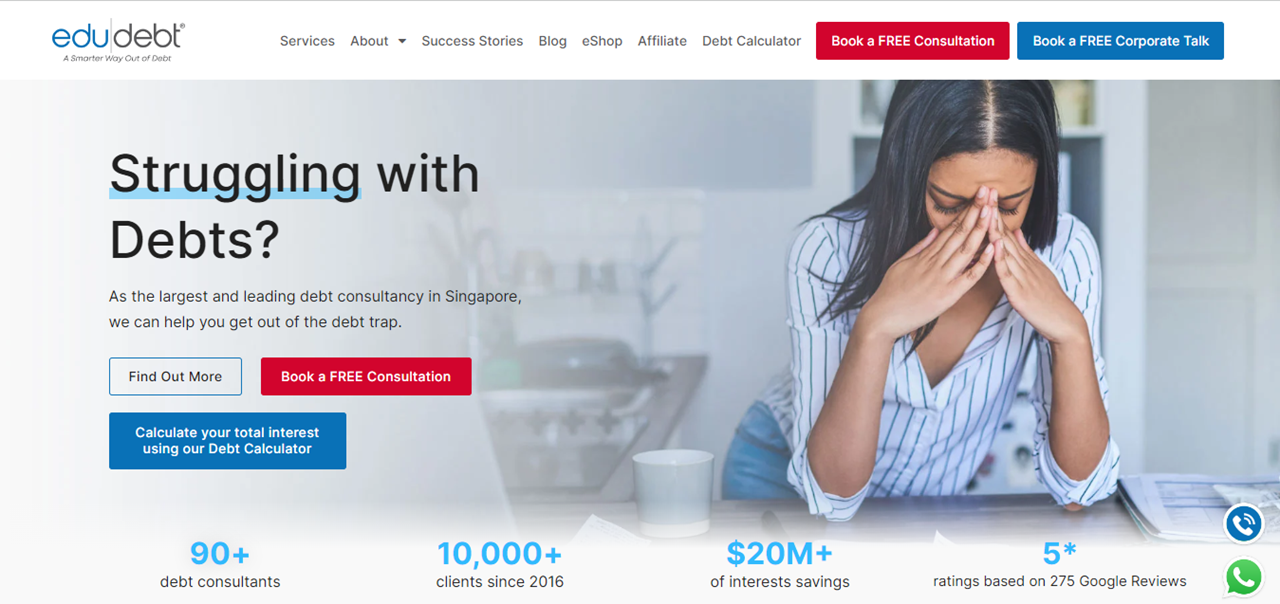

In the modern financial landscape, managing debt is a critical skill for maintaining financial stability and achieving economic freedom. EDUdebt emerges as a strategic partner, offering comprehensive services designed to help individuals navigate the complexities of debt and pave the way toward a debt-free future. This article explores the innovative solutions provided by EDUdebt and how they can transform your approach to debt management.

Understanding Your Debt with EDUdebt

Before you can effectively manage debt, you need a deep understanding of your current financial situation. EDUdebt assists in this initial step with a range of tools that analyze and interpret your debt profile.

Comprehensive Debt Analysis

EDUdebt’s platform begins with a thorough assessment of your debts, including amounts, interest rates, and repayment terms. This analysis helps to identify the most pressing debts and creates a foundation for a tailored debt management strategy.

Visual Tools for Better Insight

Through intuitive dashboards and visualizations, best debt consultant – EDUdebt helps you see your total debt in relation to your income and other financial obligations. These tools are crucial for recognizing the impact of debt on your overall financial health.

Personalized Debt Management Strategies

Each individual’s debt situation is unique, which means a one-size-fits-all approach is not effective. EDUdebt understands this and offers personalized debt management plans that cater to specific needs.

Tailored Repayment Plans

Based on your financial assessment, EDUdebt creates a customized repayment plan that optimizes your financial resources. Whether it’s choosing the right debt to pay off first or adjusting monthly payments, these plans are designed to maximize your ability to reduce debt efficiently.

Expert Guidance and Support

EDUdebt provides not only tools but also access to financial experts who can offer guidance and support throughout your debt management journey. These professionals are available to answer questions, provide advice, and adjust strategies as your financial situation evolves.

Budgeting Tools to Stay on Track

Effective budgeting is key to managing debt. EDUdebt integrates powerful budgeting tools that help you allocate your income wisely to ensure debt repayment while maintaining enough liquidity for other essential expenses.

Setting Up a Practical Budget

EDUdebt assists in setting up a budget that accounts for all your expenses, ensuring that you have a realistic plan for your income. This includes fixed and variable expenses, from housing and utilities to entertainment and personal care.

Monitoring Spending

With real-time tracking features, EDUdebt’s platform allows you to monitor your spending patterns closely. This oversight is crucial for staying within your budget and identifying potential savings that can be redirected towards debt repayment.

Innovative Saving Strategies

In addition to managing debt, building savings is essential for long-term financial health. EDUdebt provides strategies and tools to help you save effectively, even while you are paying down debt.

Automated Saving Tools

EDUdebt’s automated tools can help you set aside a portion of your income into savings accounts or investment plans. These tools ensure that saving becomes a regular part of your financial routine without requiring constant attention.

Building an Emergency Fund

EDUdebt emphasizes the importance of an emergency fund to protect against unexpected expenses. The platform offers guidance on how much to save and the best strategies for building and maintaining this fund.

Continuous Education and Resources

EDUdebt is committed to continuous financial education, providing a wealth of resources that help you expand your understanding of debt management and personal finance.

Educational Workshops and Webinars

Through workshops, webinars, and other educational programs, EDUdebt keeps you informed about the latest trends and techniques in debt management and financial planning.

Comprehensive Resource Library

EDUdebt offers access to a broad library of articles, case studies, and other materials that can enhance your knowledge and skills in managing your finances.

Conclusion: Your Path to Financial Freedom

EDUdebt stands out as a dynamic partner in your journey toward a debt-free future. With personalized strategies, robust tools, and continuous support, EDUdebt equips you with everything you need to manage your debt effectively and achieve financial stability. By collaborating with EDUdebt, you can take control of your financial destiny and step confidently toward achieving and sustaining financial freedom.